A consolidated e-invoice in Malaysia is a single digital invoice that combines multiple transactions from a customer over a specific period.

It’s used when a buyer doesn’t require an individual e-invoice for each transaction.

Here are some benefits of consolidated e-invoicing:

- Reduces paperwork: Suppliers can aggregate multiple receipts into a single consolidated e-invoice, reducing administrative burden for both parties.

- Simplifies the submission process: Suppliers can submit a single consolidated e-invoice to the Inland Revenue Board of Malaysia (IRBM) monthly.

- Ensures compliance: Suppliers can comply with the IRBM’s e-invoicing mandate.

Here are some guidelines for consolidated e-invoicing in Malaysia:

- Suppliers must submit the consolidated e-invoice to the IRBM within 7 calendar days after the end of the month.

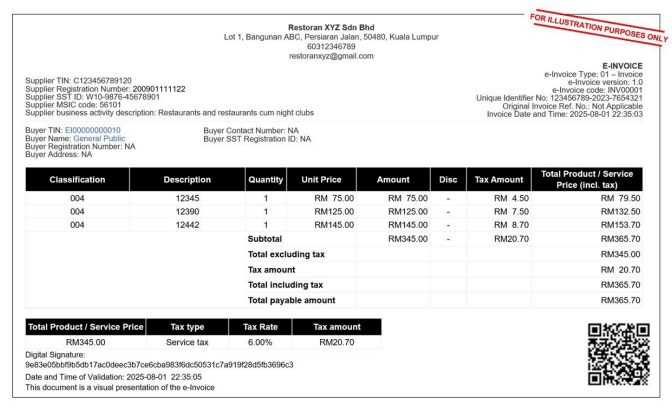

- The consolidated invoice reports are issued to the “general public” without specifying each buyer.

- A general TIN is provided.

- A description of the products or services is provided.

- MyInvois will send notifications back to the supplier only.

- Rejections are not allowed from the buyer side.

- Suppliers are not required to share the validated e-invoice with buyers.

| No. | Data Field | Remarks |

|---|---|---|

| 1 | Buyer’s Name | “General Public” |

| 2 | Buyer’s TIN | “EI00000000010” |

| 3 | Buyer’s Registration / Identification Number / Passport Number | “N/A” |

| 4 | Buyer’s Address | “N/A” |

| 5 | Buyer’s Contact Number | “N/A” |

| 6 | Buyer’s SST Registration Number | “N/A” |

| 7 | Description of Product/ Services | IRBM allows the Suppliers to adopt one (or a combination) of the following methods: (a) Summary of each receipt is presented as separate line items (b) List of receipts (in a continuous receipt number) is presented as line items (i.e., where there is a break of the receipt number chain, the next chain shall be included as a new line item) (c) Branch(es) or location(s) will submit consolidated e-Invoice, adopting either (a) or (b) above for the receipts issued by the said branch(es) or location(s) Note that for any method adopted by businesses, the receipt reference number for each transaction are required to be included under this field in the consolidated e-Invoice |

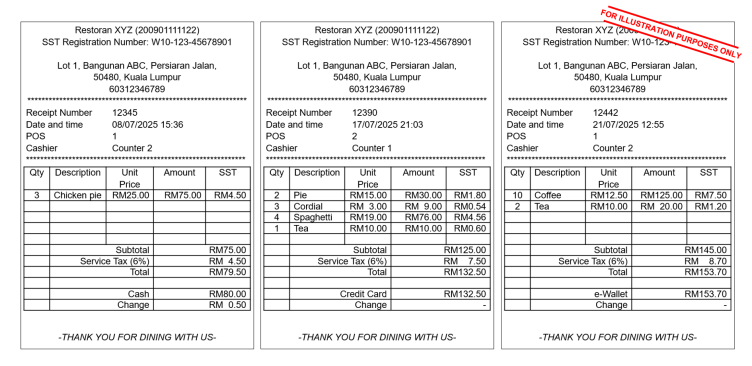

Example 3

Wani, Lilian and Muthu (Buyers) dined at Restaurant XYZ (Supplier) on 8 July, 17 July and 21 July respectively. They did not request for an e-Invoice. As such, Restoran XYZ issued receipts to them.

On 1 August 2025 (i.e., within seven (7) calendar days after the month end), Restoran XYZ aggregates all receipts for the month of July and issues a consolidated e-Invoice and transmits it to IRBM for validation.

The IRBM announced a 6-month grace period starting August 1, 2024. During this period, taxpayers can issue consolidated e-invoices for all transactions without incurring penalties.

During this time, taxpayers can:

- Use their current invoicing formats

- Aggregate transactions into a single consolidated e-invoice

- Submit the consolidated e-invoice to the LHDN for validation within seven days of the end of the month

e-Invoice Implementation Relaxation Period

| Targeted Taxpayers | Interim Relaxation Period |

| Annual turnover more than RM100 million | 1 August 2024 to 31 January 2025 |

| Annual turnover more than RM25 million (up to RM100 million) | 1 January 2025 to 30 June 2025 |

| Annual turnover more than RM150 thousand (up to RM25 million) | 1 July 2025 to 31 December 2025 |