An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes.

An e-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item description, quantity, price excluding tax, tax, and total amount, which records transaction data for daily business operations.

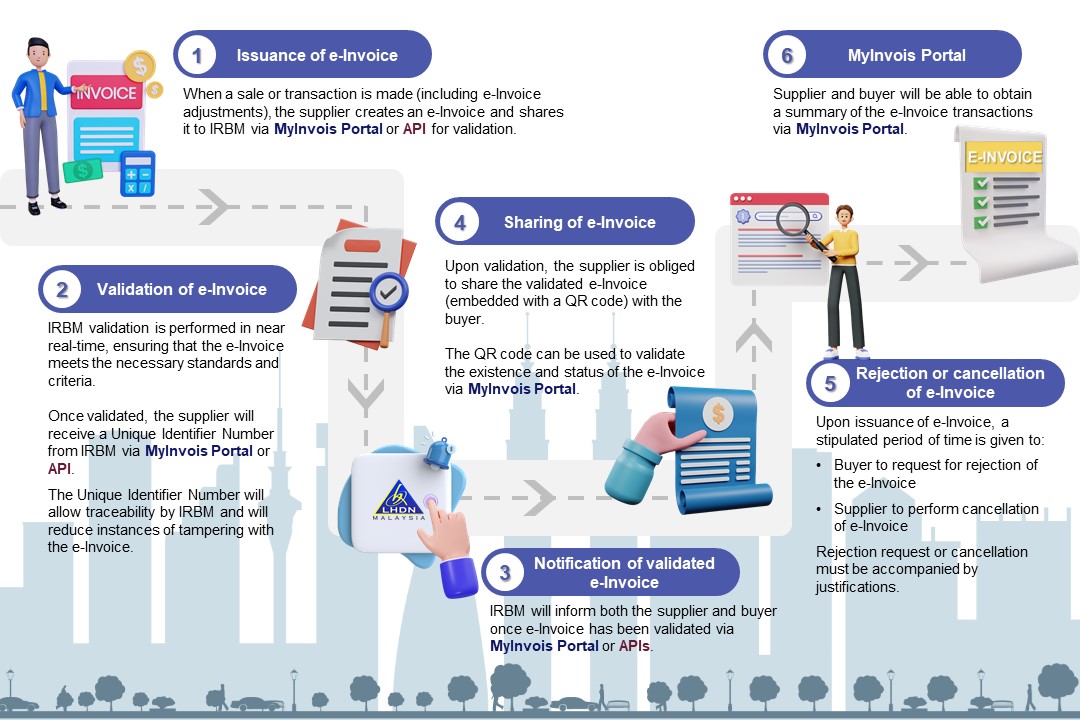

The e-invoicing flow in Malaysia is as follows:

- Issuance: A supplier creates and sends an e-invoice to the Inland Revenue Board of Malaysia (IRBM). This can be done through the MyInvois Portal or through an API.

- Validation: The IRBM validates the e-invoice in real time and assigns a unique identifier and QR code.

- Notification: The IRBM notifies both the supplier and the buyer of the validated e-invoice.

- Sharing: The supplier shares the validated e-invoice with the buyer, including the QR code.

- Rejection or cancellation: The buyer can request rejection or the supplier can cancel within 72 hours. Justification is required for any changes or rejection.

- Sharing in human readable format: The supplier can share the e-invoice in a human readable format, such as PDF or JPG. The QR code must be included so that the recipient can validate the invoice with the IRBM.

How to Make an e-invoice?

There are two (2) ways to make an e-Invoice:

1. MyInvois Portal

- The MyInvois Portal is an e-invoicing solution provided by IRBM at no charge.

- Accessible via computers, laptops, and smartphones, the portal enables users to manage e-Invoice efficiently from anywhere, at any time.

- MyInvois app also available for download on iOS, Android, and Huawei platforms.

2. Accounting Software (API)

- An API is a set of programming code that enables direct data transmission between the taxpayers’ system and MyInvois system

- Requires upfront investment in technology and adjustments to taxpayers existing systems

- Ideal for large taxpayers or businesses with substantial transaction volumes

e-Invoice Implementation Timeline

| Targeted Taxpayers | Implementation Date |

| Annual turnover more than RM100 million | 1 August 2024 |

| Annual turnover more than RM25 million (up to RM100 million) | 1 January 2025 |

| Annual turnover more than RM150 thousand (up to RM25 million) | 1 July 2025 |

Where the Buyer Does Not Require an e-Invoice:

- The supplier will issue a receipt/bill/invoice to the buyer as per normal business practice.

- However, the supplier is required to aggregate transactions with buyers who do not require e-Invoices on a monthly basis and submit a consolidated e-Invoice to the IRB within seven calendar days after the month-end.

- If the buyer requires an e-Invoice after receiving the receipt/bill/invoice from the supplier, the buyer can request an e-Invoice from the supplier within the month of the transaction.

- The e-Invoice Specific Guideline provides guidance on the consolidation methods and details to be included in the consolidated e-Invoices.

- The e-Invoice Specific Guideline also specifically provides that the consolidation of e-Invoices is not allowed for the following activities/transactions:

- Sale of any motor vehicles;

- Sale of flight tickets;

- Private charters of aircraft;

- Activities relating to luxury goods and jewellery (Further details will be released by the IRB;

- Construction contractors undertaking construction contracts, as defined in the Income Tax (Construction Contracts) Regulations 2007;

- Sale of construction materials by wholesalers and retailers of construction materials, regardless of the volume sold;

- Payout to winners for all betting and gaming activities in the licensed betting and gaming industry; and

- Payments made to agents, dealers or distributors as defined under Section 83A(4) of the Income Tax Act 1967 (ITA).

When to Self-billed e-Invoice?

Generally, a supplier is required to issue an e-Invoice to a buyer. An e-Invoice serves as proof of income for the supplier and proof of expense for the buyer. However, there are certain circumstances where another party (other than the supplier) is allowed to issue a self-billed e-Invoice on behalf of the supplier.

Self-billed e-Invoices will be allowed for the following transactions:

- Payment to agents, dealers and distributors

- Goods sold or services rendered by foreign suppliers

- Profit distribution, e.g., dividend distribution

- e-Commerce transactions

- Payouts to betting and gaming winners

- Acquisition of goods or services from individuals who are not conducting a business

Where a buyer (payer) is required to issue a self-billed e-Invoice, the buyer (payer) will assume the role of the supplier (payee) as the issuer of the e-Invoice. The buyer (payer) is required to submit the self-billed e-Invoice to the IRB for validation. Upon validation, the buyer (payer) can use the validated e-Invoice as proof of expense for tax purposes.

Sources: Inland Revenue Board of Malaysia (LHDN)

- Download e-Invoice Guideline Version 4.0 (published on 04 October 2024)

- Download e-Invoice Specific Guideline Version 3.1 (published on 04 October 2024)

- View e-Invoice Illustration Guide (Updated on 11 September 2024)